Travel

Frequently Asked Questions

Question Category

- Air Travel

- Booking Tool

- E-Travel

- Per Diems

- Personal Travel Deviations

- Reimbursements

- Rental Cars

- Vehicles

Air Travel

01. May a traveler use companion coupons in conjunction with State travel?

03. Can a traveler be required to fly a particular airline?

04. Does E-Travel affect a traveler's ability to accumulate miles?

05. What is the rural air contract and who administers it?

07. How do I know which rural fare to book?

08. What is the difference between a chartered and scheduled flight?

E-Travel

02. What is the role of travel coordinators, travel administrators, and travel planners?

03. What is required for travel approvals?

04. Can travelers be set up to select their own arrangements?

05. Can I still call the travel management contractor for travel arrangements?

06. When should travelers contact the travel management contractor directly?

07. Should the travel management contractor be used for arranging travel for non-employees?

08. What are the fees associated with E-Travel?

Per Diems

01. Why was the M&IE computation for first and last days of travel changed to 75%?

02. What is the M&IE reimbursement rate during the first and last travel day?

03. Is the rate affected by the time of day that I leave or return?

04. Are there any exceptions to this policy?

05. Can I get an exemption/waiver from the policy related to the prorated M&IE allowance of 75%?

06. Does the 75% rule also apply for out of state travel?

07. Does the 75% rule apply to same day travel?

09. If a meal is provided to me on the day I fly home, can I still claim the 75% M&IE per diem?

10. How is the M&IE rate for the first and last days of travel computed?

11. Must departments rigidly adhere to the travel timeframes in AAM 60.040?

12. Is the rental of a travel trailer considered commercial lodging, or noncommercial lodging?

Personal Travel Deviations

01. Why was the policy regarding personal deviated travel updated effective January 1, 2021?

02. What is personal or deviated travel?

03. What is a State-Authorized Fare Quote/Minimum Business Itinerary (MBI)?

04. If I had deviated travel and forgot to obtain a fare quote will I get reimbursed?

05. How much will the State reimburse?

06. How do I obtain a valid State-Authorized Fare Quote?

08. How do I book and pay for my deviated travel?

09. If my trip includes personal travel with a routing change how do I book my airfare?

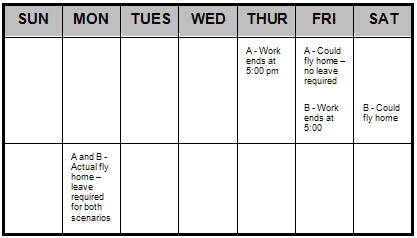

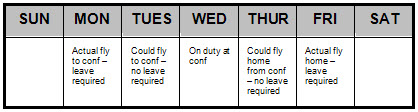

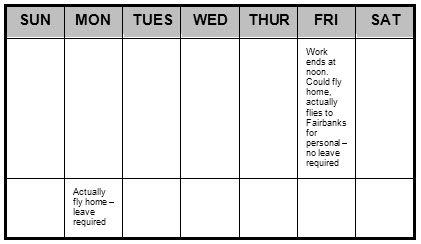

13. Can a traveler elect to stay over the weekend, or use leave in conjunction with State travel?

25. Can a traveler traveling on a personal deviation call into CTM to make changes to their trip?

Reimbursements

03. What is the process for reimbursing the traveler or the State once travel is complete?

05. Are receipts required to reimburse travelers for taxi fares?

09. Does the State of Alaska reimburse employees for valet parking?

15. Will the State reimburse employees for the cost of obtaining a passport?

16. Will the state reimburse employees for the cost of renting a Global Positioning System (GPS)?

17. Will the State reimburse employees the registration fee for TSA Pre-Check?

19. If I am charged a tip on my rideshare bill will the State reimburse?

20. Can I get an electronic device allowance if I use a rideshare application on my personal device?

23. Is mileage taxable for travel within the defined Duty Station?

Rental Cars

01. Why must State rental cars be turned in when travelers leave State travel status?

02. What justification is required to rent larger than mid-size car?

03. Is a non-employee traveling on State business eligible to rent a car under the State contract?

06. Can employees who have restrictions on their driver’s license rent a vehicle?

10. How is the State Minimum Business itinerary rate determined for a rental car reimbursement?